The Challenge

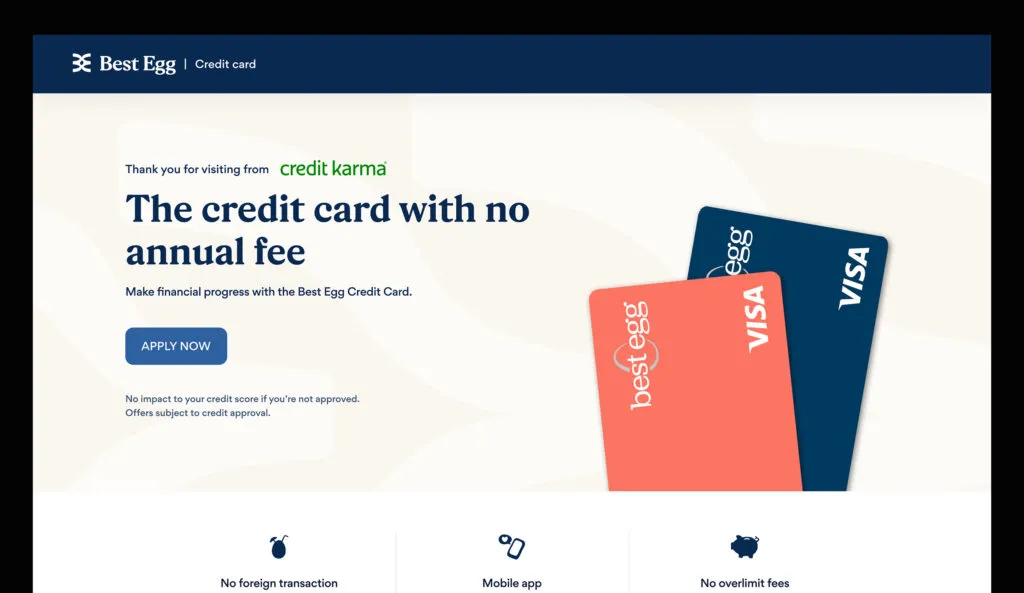

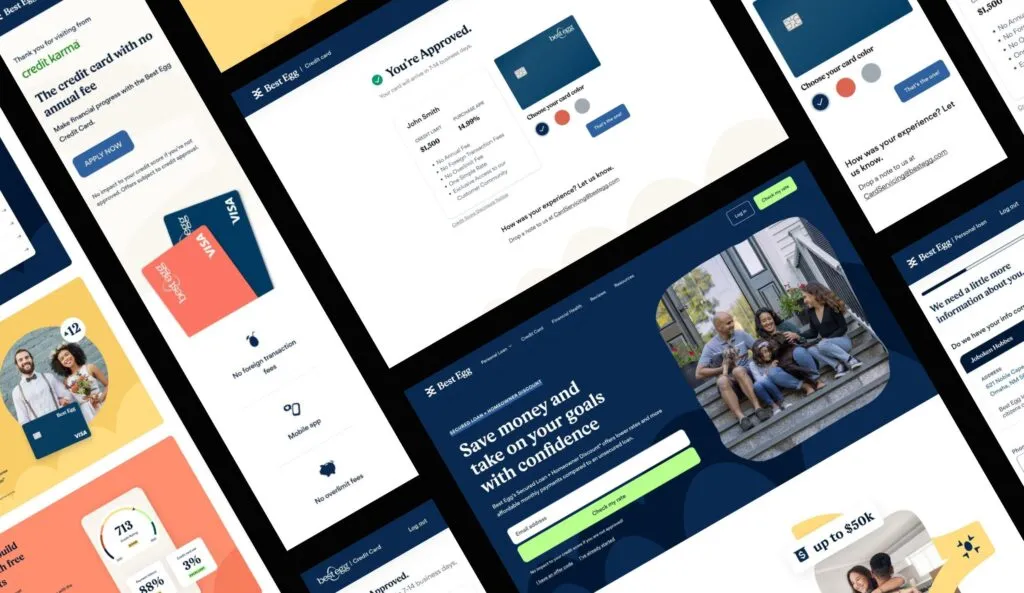

Leading online credit and financial wellness platform, Best Egg, offers financial products and resources to help inspire confidence in consumers as they manage their everyday finances. Whether consumers are looking for a personal loan to help with home improvements or debt consolidation, a resource to help them better understand their financial health, or a credit card designed for those who are looking to build or rebuild their credit, Best Egg can help support them as they work to meet their financial goals. The team learned through consumer insights that there was a need for a platform to provide guidance to those who are looking to improve their financial health, specifically within their credit score. Best Egg responded to these learnings through dedicating resources to expand their digital offerings. Taking a customer first approach, they sought out a partner to help assess the customer journey and develop a solution with a roadmap that ensured customers’ needs were being met.

The Solution

In order to meet the needs of the target audience and help inform the new platform experience, we began by examining the customer journey within personal loans to help identify opportunities within their existing product. We conducted a series of workshops focused on developing an ideal customer experience and narrative. Informed by historical data and customer assessments, we worked with the Best Egg team to conceptualize the overall experience and created a prototype that helped visualize an end-to-end journey and highlighted key features and data points to consider as the Best Egg team built out the new platform. By going beyond requirements and creating a detailed vision for the future, we were able to inform product development and create a seamless transition from prototype to prioritized roadmap to production. Ongoing we’re working with Best Egg to explore and optimize core features of the experience and create whole new paths to capture and engage new customers.